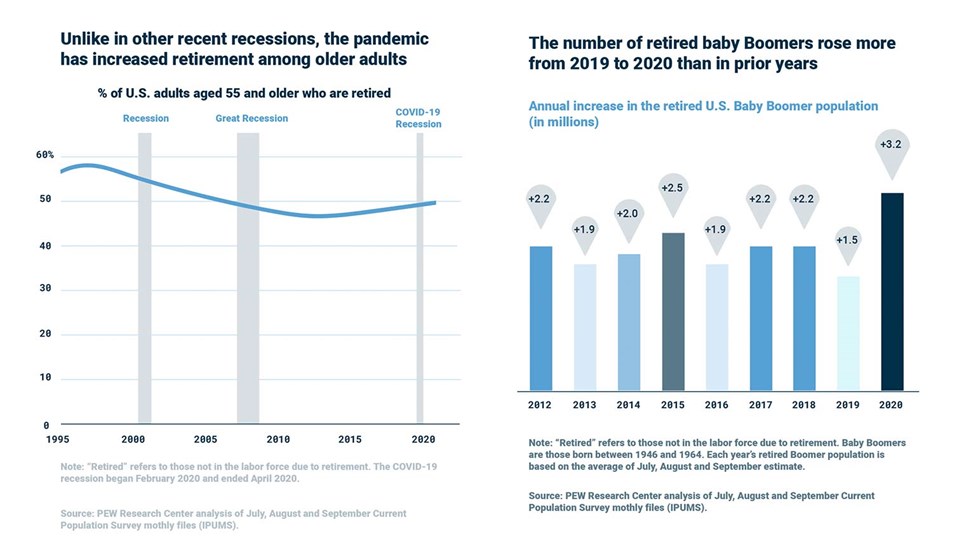

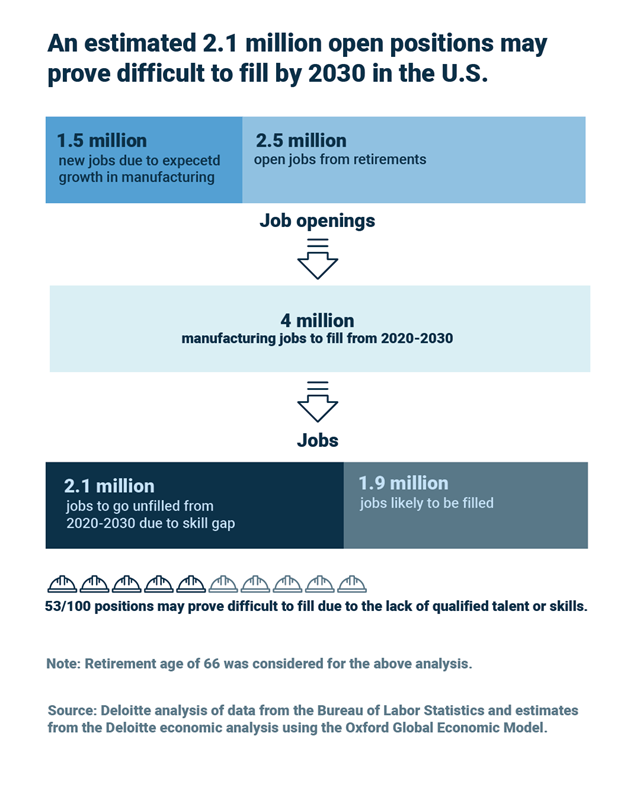

After wreaking havoc on our families, the economy, and the overall social fabric of countries around the world, COVID is abating. Or at least we are learning to live with a pandemic hanging over our collective heads. According to an article in Deloitte Insights, the North American economies are recovering, and demand is ahead of pre-COVID levels. All good – but what about manufacturing labor? When COVID exploded in March 2020, we were struggling to find workers, skilled or entry level, for manufacturing jobs in all industries. And where are we today? Deeper in the hole!

Joe Campbell is a 40+ year veteran of the robotics and automation industry. After executive assignments in sales, marketing, operations and customer service with industry leading robot, system integrator and engineering companies, Joe recently retired as head of strategic marketing for Universal Robots North America. He is a regular speaker, lecturer and author on manufacturing labor issues, and the technology and economic benefits of robots and factory automation.